GOP Legislator: College Affordability? NBD.

BY:

Students, recent graduates, and folks out of college for a while are all drowning in student loan debt. This trillion dollar crisis is a huge weight on society and something must be done.

Students, recent graduates, and folks out of college for a while are all drowning in student loan debt. This trillion dollar crisis is a huge weight on society and something must be done.

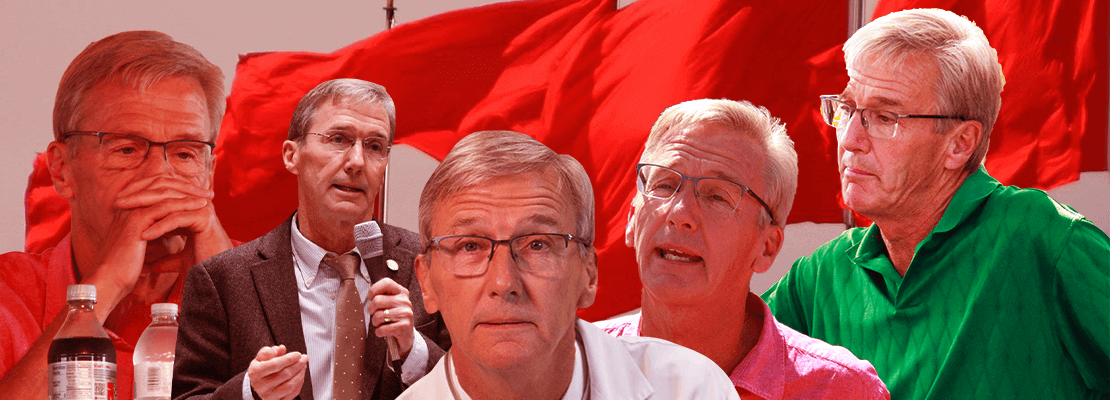

Not so much, says GOP Rep. Bud Nornes. The Chairman of the House Higher Education Committee actually just said about college affordability:

It’s “not exactly as bad as people make it out to be.”

Are you kidding me?

Minnesota is in the top five states with the highest average student loan debt (almost $31,000).

70% of Minnesota college students graduated in 2013 with some amount of debt.

How anyone can say college affordability isn’t a problem is just plain crazy when you have students graduating with tens and hundreds of thousands of dollars in debt, and are forced to put off buying a car or a house, starting a family, and saving for retirement.

Our new student loan debt campaign – Defeat Student Debt – proves just how bad this debt crisis has gotten. We’ve been hearing from hundreds of student loan borrowers about their struggles to pay off their debt.

I can only pay my student loans, little bit by little bit and continue to put my one big giant graduate loan (deep breath. . .$100k range) into forbearance. If I didn’t have that debt, I’d buy a home with my spouse. We’d have children. We’d buy a car.

Compared to others I know, my student loan debt is small with only about $15,000 owed. That is still a significant amount of money and the monthly payment is like adding another car payment to my monthly bills.

Between my wife and I we have nearly $100,000 in student loan debt. I have a good paying job now but its still going to take years to pay off that debt.

These are just a few of the stories highlighted on the Defeat Student Debt website. I challenge anyone to read through them all and then say college affordability “isn’t as bad as it’s made out to be.”

JOIN US.

contribute to the conversation